Keystone Crossing

- Springdale, AR

Since its acquisition in 2007, Keystone Crossing has continued to be a testament to Juniper’s diverse capabilities and creativity in transaction structuring and value creation.

Overview

In 2007, Juniper Investment Group was presented with an off-market opportunity to acquire Keystone Crossing. During this period, the Springdale market and Northwest Arkansas in general faced a swift downturn marked by an abundance of unfinished housing and declining rents.

Keystone Crossing suffered the consequences of this market weakness, resulting in escalating controllable expenses, growing vacancy rates, and issues with mismanagement. The core investment thesis was focused on reducing costs and enhancing operational efficiency.

Acquired 2007

Status: Active

The Results

At the time of acquisition in 2007, the property was less than 75% occupied – following a period of capital investment, operational improvement, and market recovery, the asset stabilized to 90% occupancy in 2013.

In late 2015, Juniper negotiated a discounted payoff with the holder of the participating second mortgage whereby they accepted a $1.9MM lump sum (a 53% discount of the principal amount and full forgiveness of the accrued and unpaid preferred return) for full satisfaction and release of their lien. Immediately following the discounted payoff, Juniper refinanced the first mortgage and partners invested an additional $3.15MM of equity to stabilize the capital structure.

During this time, property performance steadily improved as the asset achieved an astounding 19 quarters of consecutive revenue growth that began in Q4’14 and continued through Q2’19. Juniper executed another refinance in 2018, generating almost $4.5MM of excess proceeds of which $1.4MM was distributed to Limited Partners and the remainder was used to fund further capital improvements and bolster partnership reserves.

In 2023, Juniper closed a supplemental second lien mortgage on Keystone that generated $7.1MM in net proceeds, of which $5.7MM was distributed to partners.

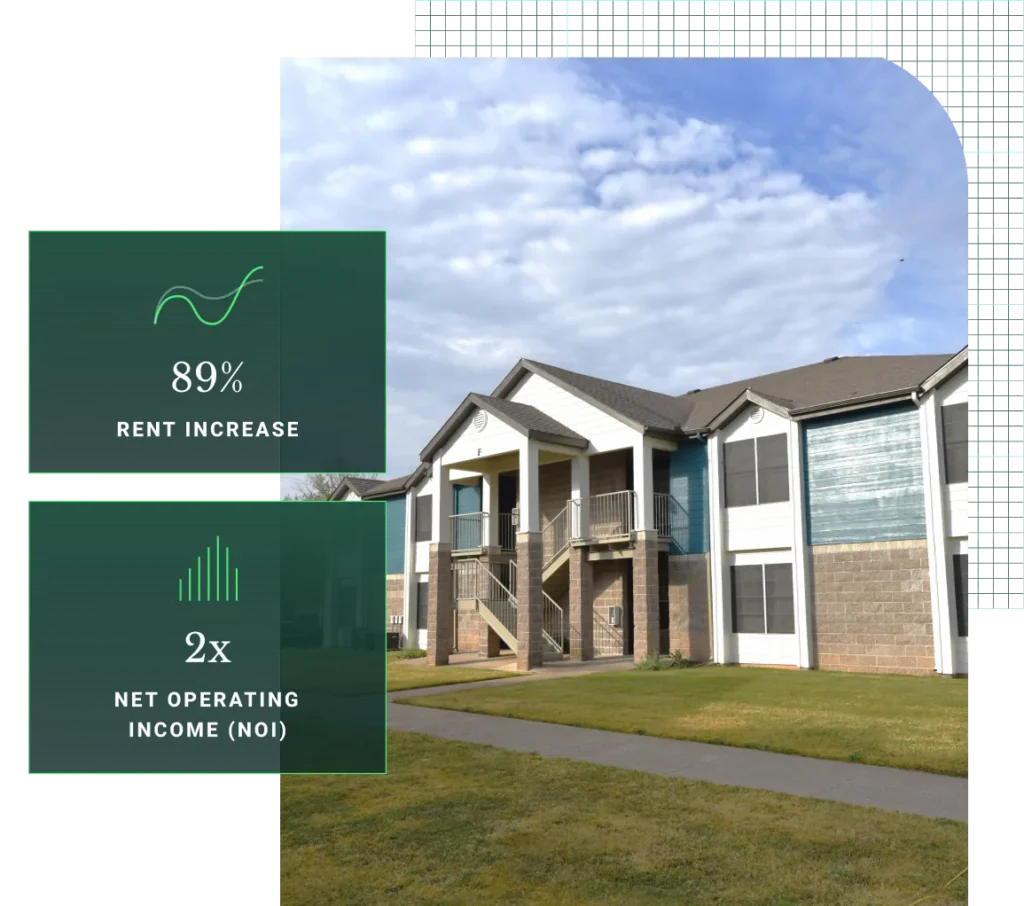

Over the course of Juniper’s stewardship, monthly Net Operating Income has nearly doubled and Limited Partners have received over 446% of their cumulative equity contribution through distributions. If the asset were to be sold, current valuation estimates imply that Keystone Crossing will deliver an investor-level IRR of 20% with an implied equity multiple of 9.7x.

all-in cost

$23,750,000

original equity

$1,000,00

initial Renovation budget

$720,000

second generation Renovation budget

$2,500,000

Year Built

2004

total units

504

avg sq. ft. / unit

715

units renovated

None

Starting rent

$450

current rent

$850

rent increase

$400 / +89%

hold period

Active